Salesforce’s true financial impact goes far beyond license fees. As your organization scales, the platform becomes a full economic system—shaping how work gets done, how quickly teams can move, and how expensive it is to change direction.

Looking at TCO across growth stages reveals a clear pattern: the mid-market inflection point (often around 200–500 users) is where costs start to spike.

Complexity piles up through customizations, integrations, and operational inefficiencies. What started as “just a CRM” becomes a major driver of both cost and risk.

This analysis maps the full picture from startup to enterprise:

- The direct costs: licenses, implementation, and ongoing operations.

- The indirect costs: technical and operational debt, productivity drag, and failed AI initiatives.

- The inflection point where complexity takes off.

- The cleanup options and ROI models that separate “unwieldy CRM” from “strategic platform.”

Organizations that treat Salesforce as a strategic system — investing in platform consolidation, automation, and data governance — can realistically reduce TCO by 30–40% while accelerating time-to-value from their Salesforce investments.

1. The Salesforce TCO Challenge

Salesforce economics are a bit... of what you might call a "paradox."

On one hand, you get a powerful and flexible platform for customer management and GTM ops. On the other, the pricing model and near-infinite customization options can create unpredictable, escalating cost structures, especially as your business grows.

The big shift: Salesforce is not just a software expense. It’s a core business capability with direct impact on:

- Operational efficiency

- Strategic agility

- Overall financial performance

Traditional ROI decks usually stop at license costs and a handful of “uplift” metrics. They rarely capture the hidden complexity costs that appear as usage scales:

- Technical debt from years of fast-and-loose customizations

- Productivity drains from manual workarounds

- Opportunity costs when innovation projects stall or fail

We think a serious TCO view has to include the full lifecycle of the platform: from initial rollout to the messy middle years where complexity peaks. That’s where the biggest financial impacts show up. Especially during growth transitions from basic CRM to a highly integrated, multi-cloud environment.

2. Direct Costs: The Iceberg

2.1 Licensing and Subscription Costs

Salesforce uses a tiered, per-user pricing model that scales with both user count and feature set. It’s simple on paper and very expensive at scale.

For larger organizations (500+ users), annual licensing spend typically lands in ranges like:

- Enterprise Edition: around $165 per user per month

- Unlimited Edition: $330+ per user per month

- Premium AI and industry solutions: often $500+ per user per month

For a 500-user org, baseline subscription costs alone can hit $1–2 million per year, before any add-ons.

Common add-on modules that expand that footprint:

- CPQ (Configure, Price, Quote): ~$75–$200 per user/month

- CRM Analytics (Tableau CRM): ~$140–$165 per user/month

- Marketing Cloud Account Engagement: starting around $1,250/month for 10,000 contacts

- Field Service: ~$50–$150 per user/month

- Data Cloud & AI capabilities: typically custom-priced via negotiation

By the time you stack these, it’s normal to see total licensing costs increase 40% to 100% over the base CRM subscription, especially in multi-business-unit environments. So yeah, double.

2.2 Implementation & Customization Expenses

Initial implementation costs swing widely based on business complexity and/or maturity:

- Small business implementations: somewhere in the $10,000–$15,000 range

- Mid-market: ~$20,000–$50,000

- Large enterprise with heavy customization: $50,000–$100,000+

And that’s just the first pass. After go-live, most orgs layer on continuous customization and optimization, which typically adds 15–20% of the initial project cost per year in ongoing work.

A major driver here is consulting partner rates:

- Higher expertise and specialization = higher hourly/daily rates

- Global vs. regional partners also shift cost structure

The important pattern: implementation is never truly “done.” New business requirements, Salesforce releases, and org changes all drive recurring projects.

Over 3 to 5 years, the total implementation spend often ends up 2 to 3x the original project cost, especially in fast-changing businesses and industries.

2.3 Ongoing Ops Costs

Once the system is live, operational costs quietly compound. Typical categories include:

- Support and maintenance: often 15 to 20% of initial implementation cost annually

- Storage overages: fees for exceeding included data/file storage

- Premium support plans: e.g., Premier Success adding roughly 30% to net license fees

- Admin/Dev/Architect headcount: internal Salesforce talent

- AppExchange apps: recurring licenses for ecosystem extensions

For growing organizations, these costs don’t scale with only user count —they scale with complexity. More customizations, more integrations, more business units means more time, more people, more risk.

Over a 3–5 year window, total Salesforce TCO frequently lands at 2.5–4x the initial implementation cost, with 500-user organizations easily spending $3–5M+ over five years.

3. Indirect Costs: The Hidden Economics of Complexity

3.1 Operational Debt and Productivity Drain

Operational debt is what happens when short-term workarounds become permanent business process.

You see it show up as:

- Manual workarounds:

Users re-entering data across systems, manually assembling reports, or spreadsheeting around gaps. - Broken or brittle processes:

Automations that fail silently, approvals that hang, flows that require manual nudges. - Meeting overload:

Extra coordination meetings to manage processes that should be handled by the system.

In moderately complex CRM environments, research suggests that users lose around 20% of their time to these kinds of inefficiencies. That’s roughly one day per week, per user — an enormous productivity and cost hit that rarely shows up on your budget

3.2 Tech Debt and Platform Fragility

Technical debt is the future cost you commit to when you choose “fast” over “right.”

In Salesforce, it tends to accumulate as:

- Over-customization:

Too many custom objects, fields, triggers, and hard-coded logic. - Integration spaghetti:

Point-to-point APIs and ad-hoc integrations that break in chains. - Fragmented configuration:

Conflicting validation rules, automation, and security models across teams.

The bill comes due during:

- Major upgrades

- CPQ migrations

- Org consolidations

- Large-scale AI or data projects

In one CPQ migration example, a Business Applications leader described having “two versions of CPQ running within the same CPQ,” buried under custom code—forcing a massive debt unwind before they could move forward. For mid-sized orgs, this kind of remediation often requires 6–12 months of work and $200,000–$500,000 in spend.

3.3 Failed AI and Innovation Initiatives

AI is a force multiplier.

Or a money pit.

Industry-wide, roughly 80% of corporate AI initiatives fail to meet expectations. The main reasons:

- Weak data foundation:

Dirty, incomplete, or fragmented data undermines models. - Mis-scoped expectations:

Treating AI as magic instead of a tool tied to a clear business problem. - Implementation complexity:

Salesforce AI projects often require months of design, setup, and expert configuration.

The financial impact is twofold:

- The direct costs of licenses, consulting, and internal time.

- The opportunity cost of initiatives that don’t move the needle.

Given that Salesforce’s AI and Data Cloud products represent significant ARR exposure, failed or stalled projects can quickly become one of the largest hidden contributors to overall TCO.

4. A Mid-Market Inflection Point: Where Complexity's Cost Spikes

4.1 Identifying the Inflection Point

As we said, the mid-market inflection point usually appears somewhere between 200–500 Salesforce users (your mileage may vary based on complexity and growth rate).

At this stage, a few things typically happen at once:

- Process fragmentation:

Different teams and regions implement their own flavors of “the same” process. - Integration proliferation:

Salesforce is now tied into finance, billing, support, marketing, product, etc., often via one-off connections. - Governance breakdown:

Informal ownership stops scaling. Changes collide. Documentation lags.

One Salesforce CPQ leader described their legacy implementation as “a terrible root that seemed to kinda go everywhere.”

That’s exactly what this inflection point looks like: a root system spreading into everything, but without intentional design.

4.2 The Warning Signs

Orgs nearing or crossing this inflection point usually show a similar set of early warning signs:

- Rising support volume:

Ticket count and complexity climbing faster than user growth. - Declining user sentiment:

“Salesforce is too slow,” “too confusing,” or “I’ll just use a spreadsheet instead.” - Slower change cycles:

Simple configuration changes suddenly take weeks. - Customization collisions:

New features break old ones; reports stop working after every deployment.

If you hit this stage without a plan, the financial fallout can be absolutely brutal. It’s not uncommon to see 40–50% escalations in TCO as teams attempt to fix foundational issues while still shipping features.

A stark example: one Director of IT reported spending $750K and two years unsuccessfully trying to connect Salesforce CPQ, Conga, and DocuSign before changing course.

5. ROI Models: Comparing Cleanup Approaches

5.1 Platform Consolidation and Simplification

Platform consolidation is a popular “clean up your room” approach: rationalize the org, remove clutter, and standardize where possible.

Key financial elements:

- Implementation costs:

~$50,000–$150,000 for a comprehensive simplification initiative. - Ongoing savings:

25–35% reduction in admin and support spend. - Productivity gains:

15–20% improvement in user efficiency through simpler processes and UX.

Organizations that run post-implementation audits every quarter see roughly 19% higher CRM ROI over 24 months, which aligns with what you’d expect when you continually chop and prune complexity instead of letting it grow wild, free, and unchecked.

Typical payback period: 12–18 months, with the biggest upside for orgs that grew fast and customized everything along the way.

5.2 Strategic Vendor Transition

When the platform is fundamentally misaligned with business needs, vendor transition becomes an option. Though it’s the most disruptive route.

A few important economic factors:

- Transition costs:

Often 60–80% of initial Salesforce implementation cost, covering migration, training, and temporary dual-running. - License savings:

Potential 20–40% reduction in ongoing license spend depending on the destination platform. - Productivity impact:

3–6 months of reduced efficiency during the switch.

Some analyses show that while Salesforce offers a lower initial investment and faster time-to-market, custom private cloud solutions can become more cost-effective over the long term for organizations with 500+ users and highly specific requirements.

Reality check: the breakeven point here is usually year 3–4, so this is a long-horizon strategy, not a quick fix.

5.3 AI and Automation Acceleration

When the data foundation is solid, AI and automation can materially move both revenue and cost metrics.

Reported outcomes include:

- Productivity:

28–34% increase in sales productivity through AI-driven automation and guidance. - Revenue:

~28% increase in cross-sell revenue and ~32% reduction in churn. - Payback:

12–15 months on focused AI investments.

The pattern among successful programs:

- Start with well-defined business problems, not “AI for AI’s sake.”

- Ensure data readiness (complete, consistent, governed).

- Expand gradually from pilots instead of going all-in on a single monolithic AI rollout.

Teams using Salesforce Einstein for predictive insights have reported around a 29% increase in win rates, which shows how targeted AI can contribute directly to top-line performance.

6. Strategic Frameworks for TCO Management

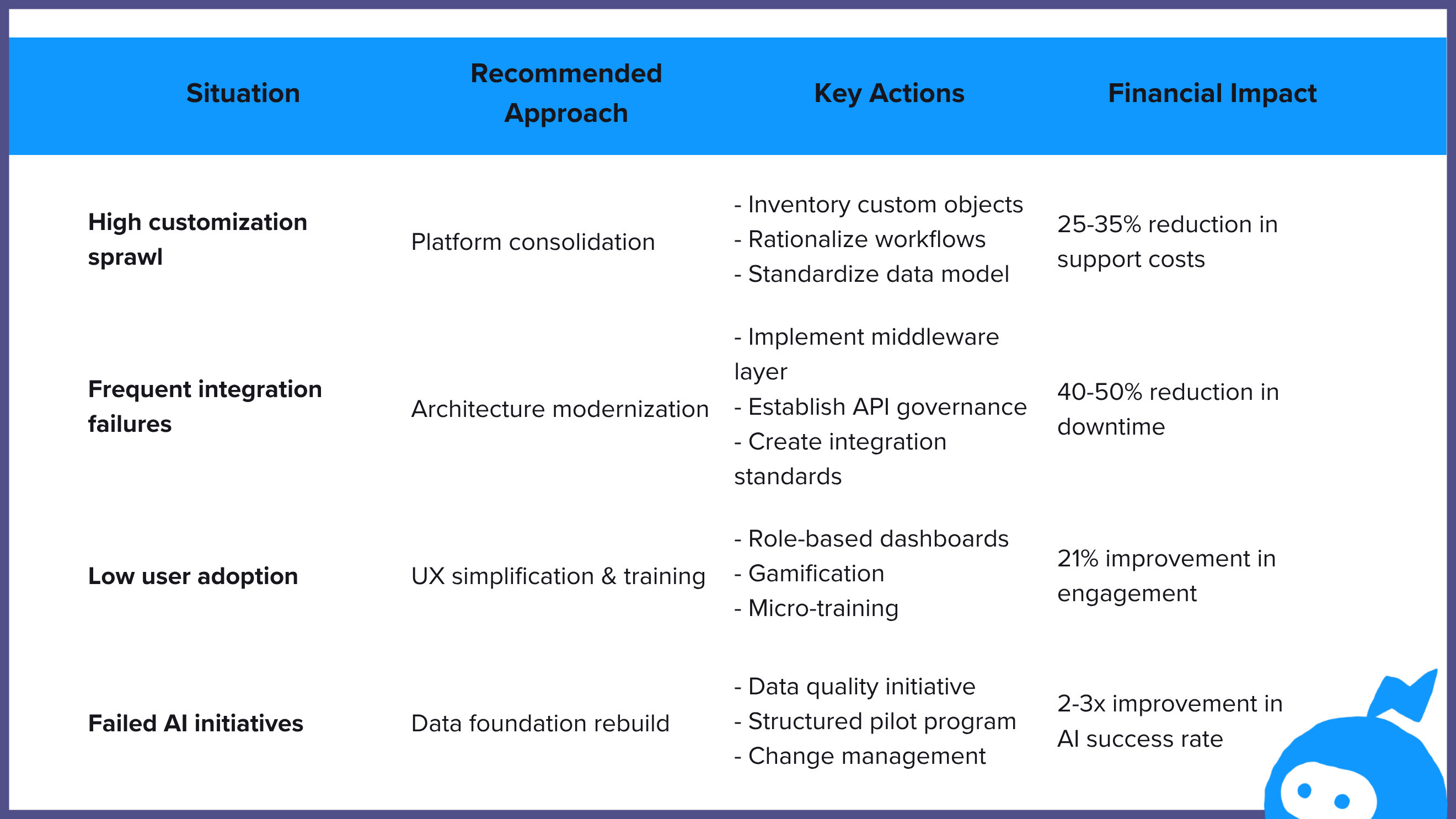

6.1 Decision Matrix for Complexity Mitigation

A structured decision framework helps match the right TCO strategy to the actual problem instead of reacting tactically.

TCO Optimization Decision Matrix

6.2 TCO Spreadsheet Framework

A practical TCO model should capture both direct and indirect costs over at least the next 3–year window. Important buckets to include:

Direct Cost Categories

- Subscription fees (by edition and user count)

- Implementation services (initial + ongoing)

- Add-on products (CPQ, Marketing Cloud, etc.)

- Storage overage charges

- Premium support tiers

- Any AppExchange app licenses

- Any training and certification

Indirect Costs

- Internal admin/dev/architect FTEs

- User productivity (time lost to inefficiencies)

- Custom development and ongoing maintenance

- Integration build and maintenance

- Downtime/business continuity impact

- Technical debt remediation projects

- Innovation and AI opportunity costs

ROI Calculation Components

- Revenue impact (conversion, deal size, velocity)

- Cost avoidance (automation, reduced manual work)

- Risk mitigation (compliance, security, resilience)

- Strategic enablement (time-to-market, scalability, agility)

Two useful meta-metrics (how apropos):

- TCO per user

- TCO as a percentage of revenue

Healthy Salesforce programs often show an average ROI around 215% with a payback period near 13 months, which can serve as a benchmark for evaluating the solidity of your own economics.

7. A Few Strategic Recommendations

The throughline here is simple: Salesforce TCO is not a one-time conversation. It’s more like an ongoing discipline.

Across growth stages and use cases, a few strategic principles consistently separate high-ROI implementations from high-drag ones.

7.1 Strategic Recommendations

- Establish TCO governance as early as possible

Put cross-team governance in place before you hit 200 users. Give it real authority over customization patterns, integration architecture, and data strategy. Done well, this can prevent 60–70% of mid-market complexity costs before they balloon. - Balance customization with standardization

Use Salesforce-native capabilities wherever you can, and reserve custom development for the truly differentiating processes. Orgs that keep 70–80% of their implementation standardized typically enjoy 30–40% lower TCO compared to heavily customized peers. - Make ROI measurement continuous, not episodic

Move from “project ROI” to ongoing TCO tracking, capturing both direct spend and indirect productivity impacts. Teams that run quarterly ROI audits tend to see about 19% higher CRM ROI over two years. - Align AI bets with your data readiness

Treat data foundation work as a prerequisite for any major AI plays. Given that around 80% of AI failures trace back to data issues, start with scoped pilots and 12–15 month payback expectations instead of big-bang transformations.

7.2 Future Outlook

Salesforce economics are evolving again with the rise of AI and agentic automation. Platforms like Agentforce are already generating meaningful ARR and closing thousands of deals, signaling growing demand for AI-native operations.

The next phase of TCO management will need to account for:

- Direct cost impacts from AI-driven automation

- Indirect impacts from better decisions, cleaner processes, and faster change cycles

The organizations that win here will treat Salesforce as a strategic value platform — intentionally balancing investment, complexity, and capability across each growth stage.

Handled that way, TCO stops being a reactive “why is this so expensive?” conversation and becomes a proactive lever for how your business grows.

8. How Sweep Can Help

If all of this sounds like a metadata and complexity problem, that’s because it is. Sweep is built to attack Salesforce TCO at the root: the tangled metadata, opaque dependencies, and accumulated systems drag that make every change slower and more expensive than it should be.

Here’s how Sweep fits into the picture:

8.1 Make Your Metadata Understandable

Sweep’s metadata agents continuously map your Salesforce (and connected systems) so you can actually see:

- How objects, fields, flows, Apex, and integrations relate to each other

- What depends on what before you change or retire anything

- Where duplication, dead config, and risky patterns are hiding

Instead of doing “impact analysis” with spreadsheets and tribal knowledge, you get a live, queryable model of your org.

8.2 Reduce Systems Drag and Technical Debt

Because Sweep understands your metadata and dependencies, it can:

- Flag redundant or conflicting automations and fields

- Surface high-risk changes before they ship

- Help you prioritize technical debt remediation by real business impact

The net effect: fewer broken releases, way less firefighting, and a steady reduction in the “invisible tax” of systems drag that inflates TCO over time.

8.3 De-Risk the Mid-Market TCO Spike

At the 200–500 user stage, most orgs are flying blind. Sweep gives you:

- Centralized governance views over config, automation, and integrations

- Clear ownership and accountability for changes across teams

- A way to enforce standards at scale without slowing everyone down

That’s exactly the window where complexity costs start to spike. Sweep’s whole job is to keep that curve from going exponential.

8.4 Make AI and Automation Actually Work Hand-in-Hand

AI fails when the underlying data and systems are a mess. Because Sweep operates at the metadata layer, it helps you:

- Identify and clean up critical objects and fields feeding AI models

- Understand which processes are good candidates for automation or agentic workflows

- Monitor ongoing changes so AI projects don’t quietly break six months after go-live

In other words: Sweep helps you get your Salesforce house in order so your AI investments don’t become another line in the “indirect costs” column.

8.5 Give Finance + Ops a Real TCO Lever

Finally, Sweep turns TCO management from a one-off spreadsheet exercise into an ongoing operational practice:

- You can track where complexity is growing, not just where money is being spent

- You can tie cleanup work to real reductions in support effort and change risk

- You can justify investments in consolidation, re-architecture, or AI with traceable metadata evidence

Instead of arguing about whether Salesforce is “too expensive,” you can show exactly which parts of the system are driving cost—and what you’re doing about it.

Sweep doesn’t replace Salesforce. It makes Salesforce behave like the strategic asset the business thought it was buying in the first place.